How to join the green bond offering?

From May 21 to 30, 2025, SIA “Rīgas ūdens”, an essential water and sewer service provider in Latvia owned by the Municipality of Riga, is organizing its first public bond offering. Both retail and institutional investors across the Baltics are invited to participate in the offering on the Nasdaq Riga stock exchange. European green bonds are offered with an annual interest rate of 4%, paid quarterly, and the maturity term is 5 years. The total bond issuance amount in the first tranche is EUR 20 million, with a nominal value of EUR 100 per bond. The Bank of Latvia has approved the Base Prospectus for SIA “Rīgas ūdens” Bond Program with a total amount EUR 60 million.

View tutorialBond nominal value —

100 EUR

Interest payments every

3 months

Annual interest rate

4%

Issuance amount

EUR 20 million

Maturity term —

5 years

"Future-ready, sustainable, and technologically advanced – this is ‘Rīgas ūdens’. We proudly take the initiative to be the first municipal company to leverage the capital market opportunities by offering green bonds to a broad range of investors, including our customers and employees," said

Krišjānis Krūmiņš,

Chairman of the Management Board of SIA "Rīgas ūdens"

Krišjānis Krūmiņš,

Chairman of the Management Board of SIA "Rīgas ūdens"

Why invest in “Rīgas ūdens”?

Water is an essential resource

A chance to enhance our everyday quality of life

European green bonds

Funding sustainable and environmentally friendly projects

Stable revenue stream

A regulatory framework that secures predictable revenue

Reliability

A long-term A3 Moody’s credit rating with a secure outlook

A strong foundation

A stable capital base for financial security and sustainable growth

Timetable of the offering

MAY 21

Start of subscription period at 10:00 EET

MAY 22

Nasdaq investor webinar

in Latvian at 14:00 EET

in English at 15:30 EET

MAY 30

End of subscription period 14:30 EET

JUNE 2

Publication of the results of the offering

JUNE 4

Settlement with investors

JUNE 5

Listing on stock exchange

Key Performance Indicators 2024

- EUR 76.3mannual revenue

- EUR 25.9mEBITDA

- EUR 8.4mnet result

- EUR 717.3mtotal assets

- EUR 55.6mnet debt

- 74.5%equity ratio

- 763employees

- 600 000+customers served

- 89%customer satisfaction

- 1 536 kmwater supply network

- 1 282 kmsewerage network

How to subscribe for bonds at the bank?

Swedbank

Step 1

Log in to your account using your Swedbank online banking credentials.

Step 2

Navigate to the “Investment” section and select “Corporate Actions, Offers.”

Step 3

From the dropdown menu of currently available public offers, select the bond you’re interested in.

Step 4

Fill in the subscription form by indicating the number of bonds you would like to purchase.

Step 5

Review and submit the form, and wait for confirmation from the bank.

Step 6

Complete any additional steps as instructed by Swedbank.

SEB

Step 1

Log in to your SEB online banking account.

Step 2

Select the “Investment” section, then go to the “Bonds” subsection.

Step 3

Type “Rīgas ūdens” in the search field.

Step 4

Click the “Buy” button and fill in the subscription form by indicating the number of bonds you would like to purchase and the price (100%).

Step 5

Review and submit your application, and follow the instructions provided.

Citadele

Step 1

If you are a Citadele customer, sign an agreement on the opening of a financial instrument account and the enabling of transactions with financial instruments.

Link to the website: https://www.citadele.lv/en/private/invest/

Step 2

Transfer funds to your financial instrument cash account in the way that's easiest for you.

The Citadele online bank: Payments > Deposit to Financial Instruments Account.

The Citadele mobile app: Pay > Between accounts.

Step 3

Submit a security purchase/sale order.

The Citadele online bank: Investments > Trading.

By calling a Citadele broker at +371 67 010 555.

Luminor

Please contact your Client Manager, who will assist you with placing the subscription order via the bank’s online banking system.

Signet bank

For existing clients: Contact your Banker or the Signet Markets team at +371 67 081 069.

For potential new clients: Please contact a Signet Client Relationship Manager at +371 29 249 330.

BluOr bank

If you already have an investment account with the bank, you can place your order using voice brokerage services by calling +371 67 034 222, or through the online banking system.

Šiaulių bankas

Via Internet Banking

In the menu bar, select “Savings and Investments” and click “Investments.”

After logging in to the Securities platform, select “Bonds.”

Click on the line of the selected bond offering and fill in the order form that opens.

Submit the order to the bank to purchase the offered bonds.

Via Šiaulių Bankas Mobile App:

After logging into the app, select “More.”

Choose “Investments.”

Log in to the securities platform.

In the platform, click the button in the upper-left corner.

Select “Bonds.”

LHV

Via Internet Banking

Step 1

Visit: https://investor.lhv.ee/en/offering and review details of the current bond offering.

Step 2

Log in to LHV Internet Bank. Use your credentials to access your account.

Step 3

Navigate to the Investments or Bonds section.

Step 4

Fill In the subscription order.

Step 5

Confirm and submit the order.

Didn't find your bank?

That doesn't mean you can't subscribe to our bonds. Please contact your bank directly for detailed instructions on how to subscribe. Bond subscriptions are available to investors in the Baltics.

Have questions?

Get in touch with us!

anastasija.barbarova@signetbank.com

(+371) 62 102 911

Frequently asked questions

About bonds

Bonds are debt securities (financial instruments) through which an investor (bondholder) lends money to a bond issuer for a fixed period of time at a predetermined interest rate. The bond issuer is obliged to pay the investors a fixed interest rate or coupon at regular intervals (e.g. quarterly) and to repay the principal amount of the bond (originally borrowed funds) to the investors upon maturity.

Green bonds are financial instruments issued to raise funds to finance and develop climate and environment friendly projects. They must comply with the European Union taxonomy, which includes a list of sustainable economic activities, and the European green bond standard.

For a bond to be offered to the public and listed on a stock exchange, a company must prepare a prospectus that is approved by the Bank of Latvia. A base prospectus is a type of prospectus that allows an issuer to implement a bond program — several bond issues — within one year. This document contains information essential for investors to make an informed assessment of the company's, also referred to as the issuer, financial performance and perspectives, issuance objectives, risk factors, strategic objectives, and other considerations before purchasing the company's bonds.

Bonds are issued for a fixed term and offer a predetermined return. Investors receive regular interest payments (coupons) on the bonds they hold, and at the end of the term, the original investment amount is repaid. Importantly, issuing bonds does not affect the company’s ownership structure. In contrast, when a company issues shares, it brings in new equity investors who become part-owners of the company. The capital raised from shares is invested in the company’s growth and does not need to be repaid. Shareholders may earn returns through dividends and can potentially profit from selling their shares on the stock exchange if the company performs well and its share value has increased.

“Rīgas ūdens” bond issue

The subscription period starts on May 21 and ends on May 30.

Purchase order collection deadline might differ depending on the investor’s chosen bank. Please do not delay your subscription until the last minute.

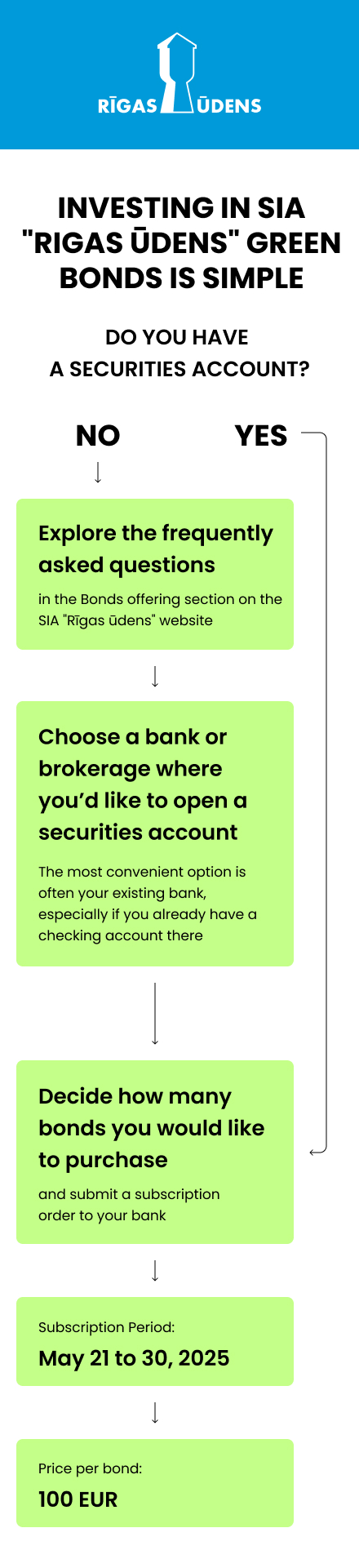

SIA “Rīgas ūdens” bond issue is open to any retail or institutional investor who has opened a securities or investment account at a Baltic commercial bank or financial institution. This type of financial accounts are designed for holding securities and making payments when buying and selling securities. Often the most convenient option is to open a securities or investment account with a bank which is used for daily banking.

Investors will be able to purchase up to 200,000 SIA “Rīgas ūdens” bonds with a total nominal value of EUR 20 million and a nominal value of EUR 100 per bond.

The price of each bond is EUR 100, corresponding to 100% of the nominal value of the bond. The minimum investment amount per investor is 1 bond or EUR 100 with an annual interest rate of 4% and a maturity of 5 years.

Under its bond program, SIA “Rīgas ūdens” offers a fixed bond coupon rate of 4% per annum, with coupon (interest) payments made quarterly to investors. At the end of the bond's maturity period, the company is also obligated to repay the investor the original principal amount of the investment.

Investors are invited to carefully review the risks related to SIA “Rīgas ūdens” bonds in the base prospectus, which is available here.

In order to further the development of Riga and to ensure clean and quality water for the residents of Riga and its surroundings, the capital raised by SIA “Rīgas ūdens” aims to renew and extend the sewerage pipeline network and modernise the biggest biological treatment plant in the Baltics, “Daugavgrīva”.

More detailed information on the use of the financing is available in the base prospectus and final terms of SIA “Rīgas ūdens”.

How to subscribe for bonds?

The minimum investment amount is 1 bond or EUR 100 for one investor.

Once the decision to invest in the bonds has been taken, a subscription (purchase) order must be submitted to your bank. If you do not have an investment or securities account, you must contact your bank to open one.

The subscription process may vary slightly among banks. Visit your bank's website, navigate to the investment section, and explore the available options. Some banks may require manual subscription, either through a phone call or by completing a written request.

The main difference between accounts lies in taxation. If you purchase bonds from an investment account, you'll only incur personal income tax when you withdraw more than your initial investment. In contrast, if you buy bonds as an individual through your own securities account, the issuer is required to withhold personal income tax at the time of withdrawal, resulting in a reduced payment to your account after tax.

Tax withholding is determined by the regulations of the country where the issuer is located, in this case, Latvia.

For Latvian residents, no tax is withheld if the individual holds the securities in an investment account. Otherwise, there will be personal income tax withheld in the amount of 25.5% if the annual amount does not exceed EUR 200,000. No tax is withheld from non-resident individuals or legal entities.

About “Rīgas ūdens”

SIA “Rīgas ūdens” was founded in 1991, but the history of water management under its supervision dates back 400 years to the first water pump and wooden pipe network in Riga.

Today, SIA “Rīgas ūdens” is the largest water supply and sewerage service provider in Latvia, providing quality drinking water and wastewater collection and treatment in Riga and the surrounding area, which accounts for around 50% of the Latvian market.

It offers a full service cycle: from water abstraction, supply, collection and treatment. This integrated supply chain model allows the company to efficiently control all processes within its scope, guaranteeing the highest possible operational efficiency and optimisation of resource use.

A credit rating provides an independent assessment of the company’s credit risk and underlines its strategic importance to the City of Riga. In June 2024, the international credit rating agency Moody’s affirmed SIA “Rīgas ūdens” a long-term credit rating of A3 with a stable outlook. Notably, SIA “Rīgas ūdens” is the only Riga municipality-owned company to have received such an international credit rating. This rating is aligned with the current A3 rating of the Republic of Latvia, highlighting the strong financial and economic position of “Rīgas ūdens” within the national context. Since a country's credit rating often sets the ceiling for ratings of state or municipal companies, achieving this level places “Rīgas ūdens” at the highest possible benchmark — and the goal now is to maintain it.

The Public Utilities Commission (SPRK) is an independent national authority responsible for overseeing public service providers, including SIA “Rīgas ūdens.” SPRK establishes the tariff methodology, ensuring that pricing remains competitive, transparent, and economically justified.

Currently, SIA “Rīgas ūdens” offers the lowest water management service tariffs in the surrounding region.

SIA “Rīgas ūdens” has developed a sustainable development strategy up to the year 2040, which plans significant investments of up to EUR 500 million. The strategy includes 15 key sustainability objectives, including upgrading water and sewerage networks, modernising treatment processes and improving wastewater management.

SIA “Rīgas ūdens” is the largest water supply and sewerage services provider in Latvia, providing drinking water and wastewater collection and treatment services to more than 600,000 residents of Riga and the surrounding area.

To achieve this, the company has continuously developed its infrastructure, which currently consists of 1,536 km of water pipes and 1,282 km of sewerage network, 6 water extraction stations, 8 water pumping stations, 5 water reservoirs, 107 wastewater pumping stations, a laboratory for water quality testing and even biogas production.

SIA “Rīgas ūdens” is also recognised as a sustainability promoter and ESG leader. The company is committed to contributing to Riga's climate neutrality by 2040, with a particular focus on wastewater treatment.

SIA “Rīgas ūdens” has a strong financial foundation – low debt levels and a stable capital base ensuring financial security and supporting sustainable growth.

In 2024, SIA “Rīgas ūdens” net turnover amounted to EUR 76.3 million, with water management services generating the highest revenue of EUR 37.1 million.

The company's EBITDA reached EUR 25.9 million last year, reflecting a 9.1% increase compared to 2023. This growth was primarily driven by a EUR 2.9 million reduction in electricity costs.

A detailed financial report is available in the Investors section and the base prospectus of SIA “Rīgas ūdens”.

The latest updates on SIA “Rīgas ūdens”, including the results of the bond issue, are available on the website of SIA “Rīgas ūdens” at rigasudens.lv.

Partners

The “Rīgas ūdens” bond issue is open to all private and institutional investors who have a securities or investment account registered with a Baltic commercial bank or financial institution. This type of financial account is designed for holding securities and processing payments related to the purchase and sale of financial instruments.

In most cases, the most convenient option is to open a securities or investment account with the bank you already use for your everyday banking needs.

Contact

More information for investors

Sandijs Māliņš

Head of Finance

(+371) 29 187 817

investoriem@rigasudens.lv

(+371) 29 187 817

investoriem@rigasudens.lv

Communications Department

(+371) 67 088 346

pr@rigasudens.lv

The content of this website is an advertisement which contains general forward-looking statements on the Public Offering of bonds of SIA “Rīgas Ūdens”. Access to this information is limited to the persons residing and physically present in Latvia, Lithuania or Estonia. This information is not for publication, distribution or release, in whole or in part, directly or indirectly, in or into the United States, Australia, Canada, Japan, Hong Kong, South Africa, Singapore, Russia, Belarus or any other jurisdiction in violation of the relevant laws of such jurisdiction. Every investment decision must be based on a prospectus approved by the Bank of Latvia. The approved prospectus is available on the Bank of Latvia website (https://bank.lv). The approval of the prospectus by the Bank of Latvia should not be understood as an endorsement of the securities.

Arranger of bond issue

Arranger of bond issue

Legal counsel

Legal counsel